Spectacular Tips About How To Avoid Cash Advance Fee

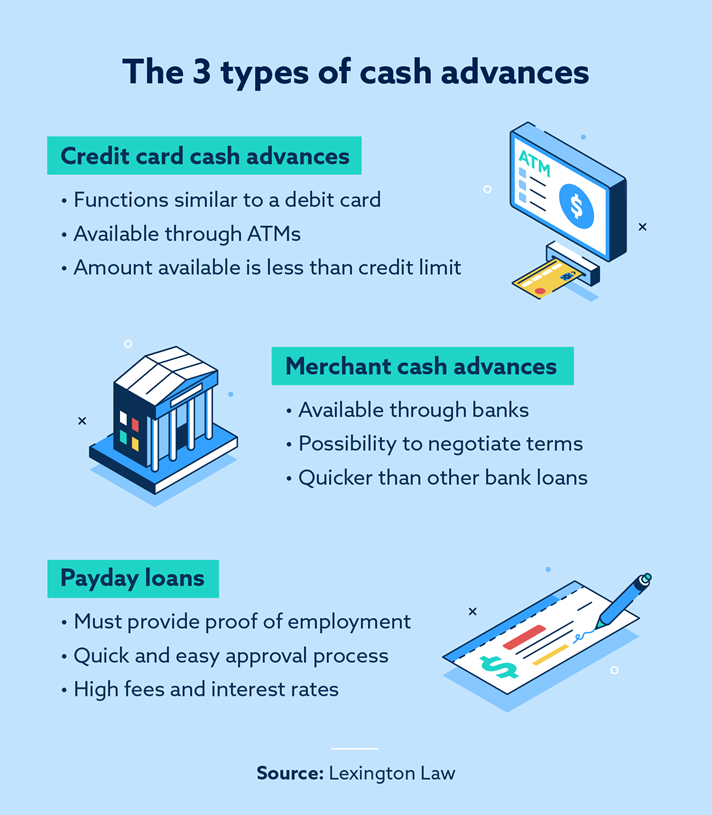

Instead of taking out a cash advance, consider borrowing money from family or friends or take out a personal loan (which usually offer better.

How to avoid cash advance fee. However, there are a few other options that can sometimes get you out of paying a cash advance fee: You can blunt the effect of cash advances by paying your balance in full as soon as possible. Find a credit card that waives your first cash advance fee.

Alternatively, you can walk into any us bank branch near you and. “the best way to avoid a cash advance fee is to simply not take out a cash advance from a credit card company,” adds frankle. To turn off atm cash advances follow these instructions:

The best way to avoid cash advance fees is to not do a cash advance with a credit card. Use a credit card to pay · 3. If you have accumulated credit card rewards, you may be.

You just won't be able to spend over your limit. To avoid the 3% fee for using a credit card to send money, users can draw funds from their venmo balance, bank account or debit card instead of using their credit card. The cash advance fee will be deducted from your credit limit just like the money you’re requesting from the cash advance.

That’s simple enough, but avoiding cash advances completely gets tricky depending on. Call the cc companies and lower the. What's the cash advance fee?

He suggests asking if the person or company you. The only way to avoid a cash advance fee is by avoiding cash advances and cash equivalent transactions on your credit card. Aug 22, 2019 — 5 ways to avoid a credit card cash advance · 1.

/credit-card-cash-advance-fee-explained-2f669e92e6404f9aa2b6bd7229723cc3.png)

/images/2022/01/04/woman_smiling_and_holding_credit_card.jpg)