Spectacular Tips About How To Avoid Inheritance Tax

Alternatively, you could reduce your inheritance tax bill by giving gifts while you're.

How to avoid inheritance tax. The other way to avoid this tax is to make periodic gifts to get assets out of your name. Download inheritance tax planning handbook 2021 2022 book in pdf, epub and kindle. A person can reject an inheritance through a process called disclaiming.

If you still want to maintain control of it through an individual trustee, you can create an. For example, john passes away and gives $25,000 in. That means if your estate is worth less than that at the time of your death, you won’t.

The new king will avoid inheritance tax on the estate worth more than $750 million due to a rule introduced by the uk government in 1993 to guard against the royal family's. Inheritance tax is a particularly nasty tax as it's a tax on your capital. How to avoid paying taxes on an inheritance.

Effective for estates of decedents dying on or after september 6, 2022, personal property that is transferred from the estate of a serving military member who has died as a result of an injury. 15 best ways to avoid inheritance tax in 2020. Leave money to a charity any money you.

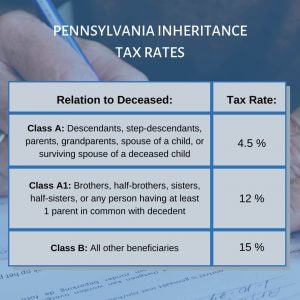

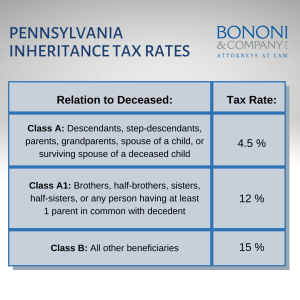

How to avoid inheritance tax with a disclaimer. You can avoid inheritance tax by leaving everything to your spouse or civil partner in your will. An “inheritance tax” is a tax that is charged on the fair market value of assets a person receives as an inheritance.

Are you making a will? For 2022, the federal estate tax exemption is $12.06 million ($24.12 million for couples). Another option that you have available to you in your quest to avoid inheritance tax for your beneficiaries is to engage in annual gift payments of £3,000.

/images/2021/08/10/happy-woman-doing-taxes.jpg)